No More Hustleporn: Where Does Yield in Crypto Come From

Tweet by Ming Zhao

https://twitter.com/FabiusMercurius

ex-Point72, ex-cyber hacker; master @ lock-picking, questionable @ stock-picking; i like maths

Where does YIELD in crypto come from?

It's 2021.

😡 $1 in Chase earns 0.05% APY.

😲 1 UST in Anchor earns 20% APY!

🤯 1 UST in a market-neutral fund running 50x levered BTC contango trades earns >300% APY!

How are crypto yields SO DAMN HIGH, and is this sustainable? 🧵.

👇

1/ Yield in crypto comes from 4 main sources

a. demand for leverage (e.g. basis trading)

b. risk premia (e.g. options writing)

c. protocol revenue (e.g. staking, LP)

d. payment-in-kind (e.g. token rewards)

For each, let's explore:

- what trades are involved

- is it sustainable?

2/ But first, some stats...

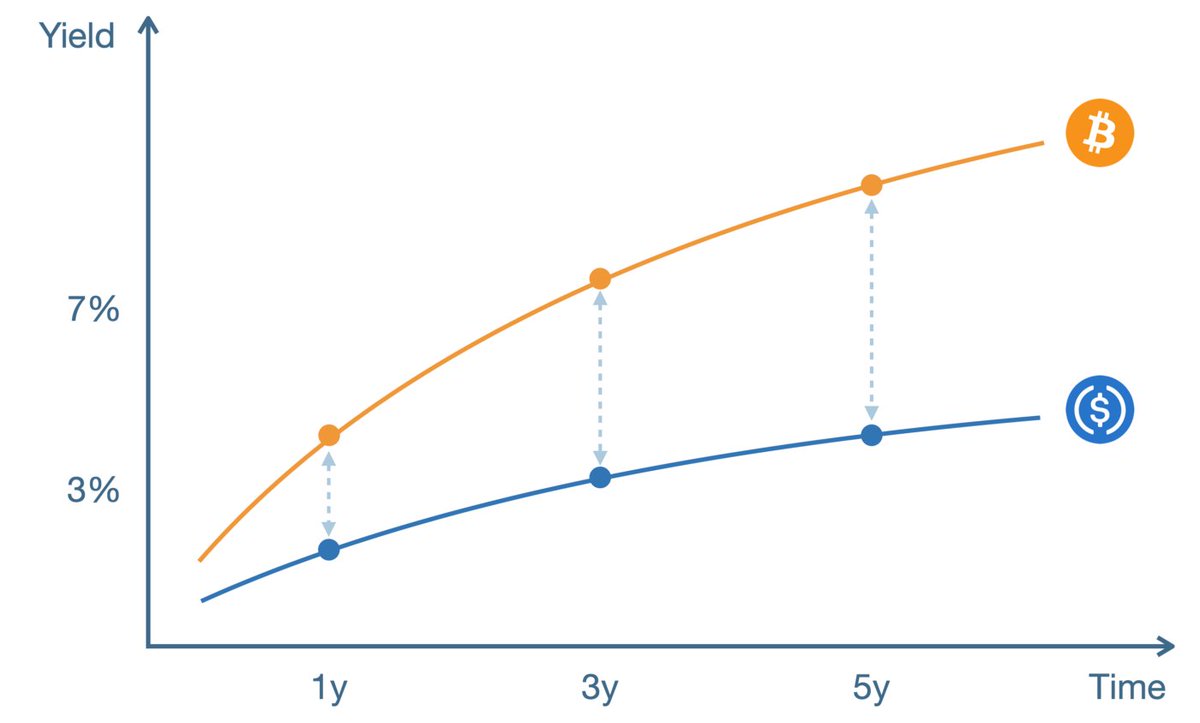

Comparing lending yields from USDC (up to 8%+) vs. USD (3.25% prime rate). 👇

[Keep this in mind for when we deep-dive on "demand for leverage"]

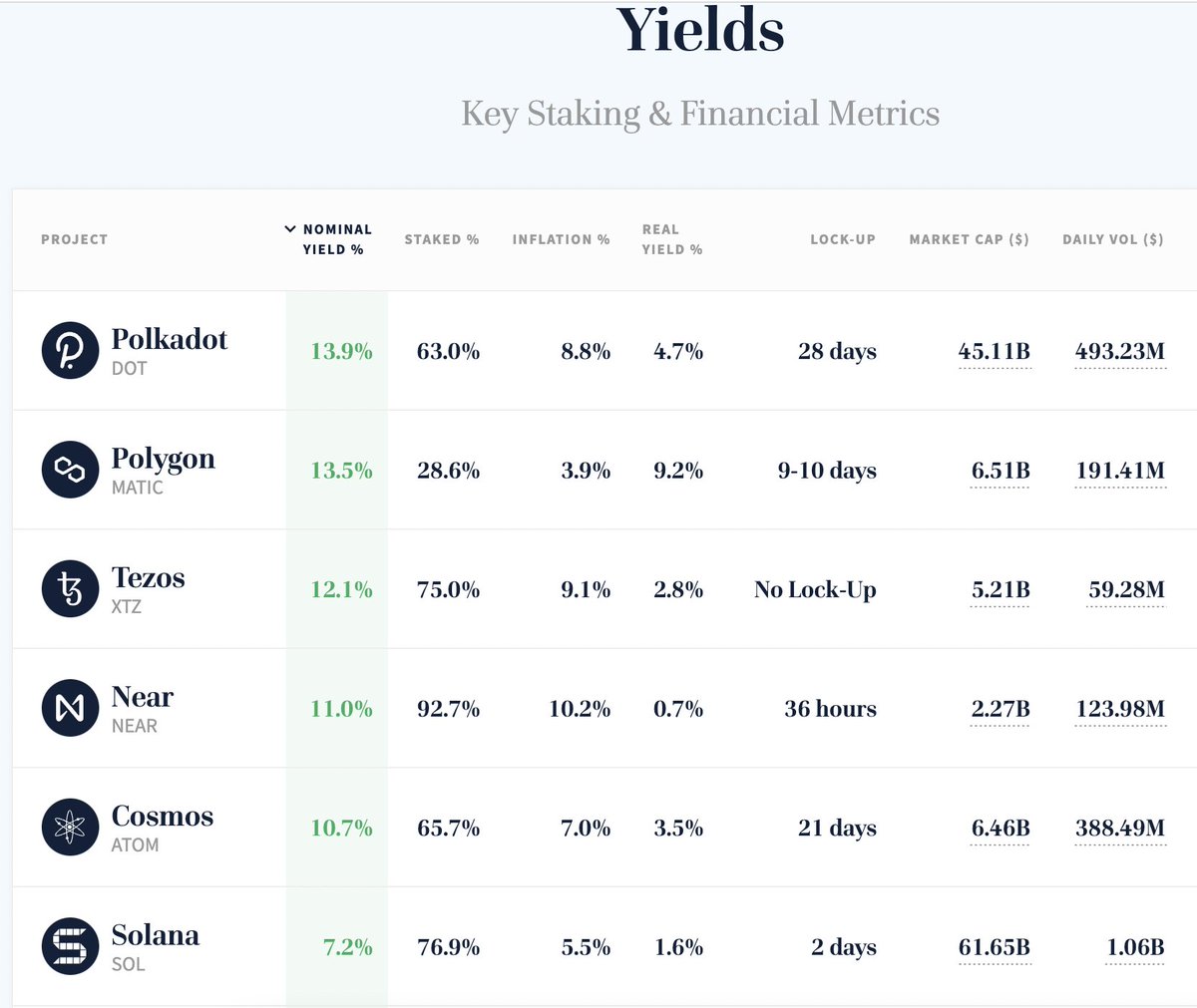

3/ Comparing staking yields for some of the highest-yielding legitimate protocols.

[Keep this in mind for when we deep-dive on "protocol revenue"]

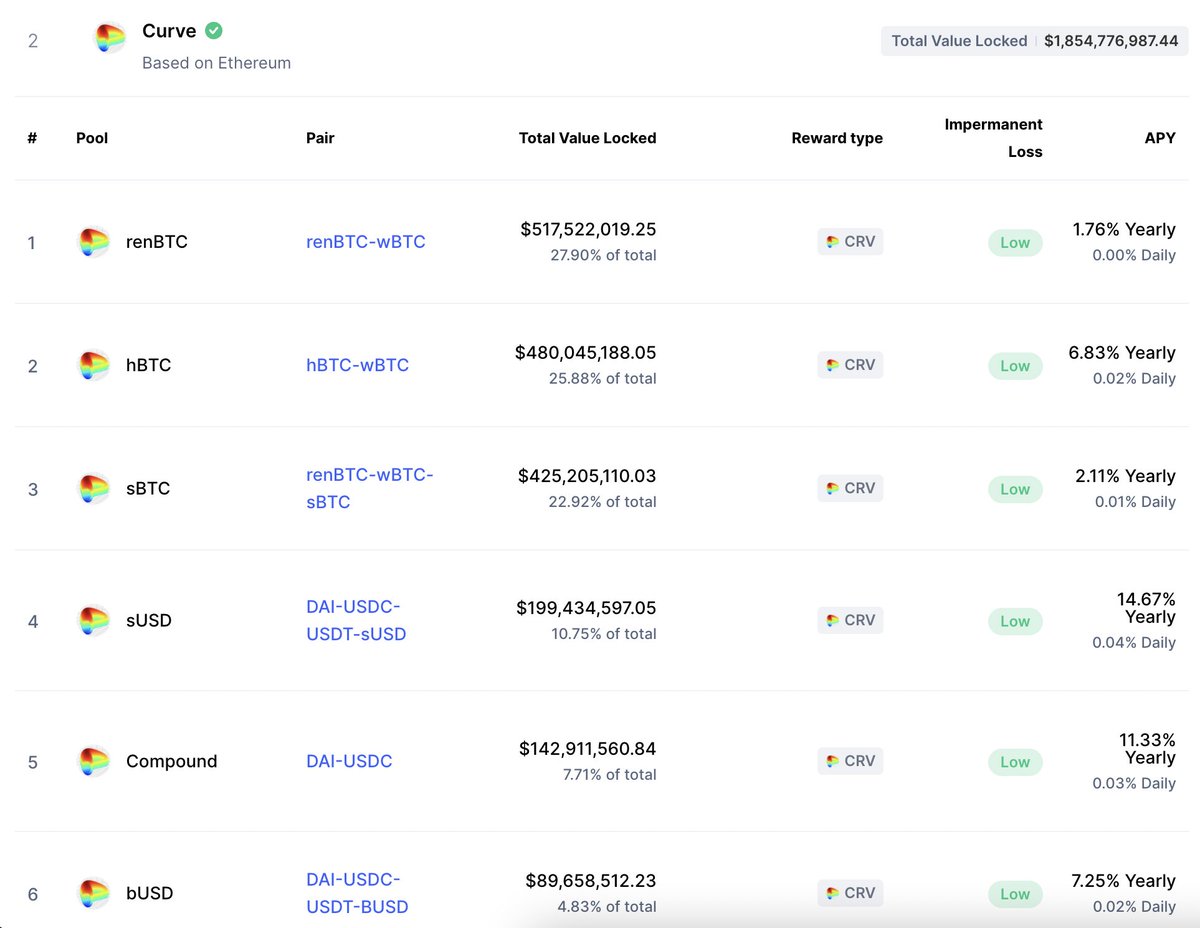

4/ Comparing yield farming rewards for various swap pairs on @CurveFinance.

[Keep this in mind for when we deep-dive on "payment-in-kind"]

Ok let's get started.

5/ Demand for leverage

Why do traders use leverage?

1. asymmetrical directional bets

2. market neutral strategies

3. capital efficiency

Degen retail traders & insiders do 1. But their capital base is small, so net contribution to demand pressure is small.

Funds do 2 & 3.

Why?

Market neutral strategies have no directional exposure e.g.

- arbing price deviations across exchanges

- long spot / short futures to earn funding rates

The borrower is unlikely to get liquidated & can use leverage to juice more returns out of existing trades w/ no added risk.

Think of it this way: would you rather be naked long BTC betting on +20% next month, or levered 5x on +4% BTC perp funding rates?

The levered basis trade clearly has better Sharpe, aka risk-adjusted returns. So given a choice, institutions/MMs would always choose the latter.

Is demand for leverage sustainable?

Yes.

But it could fluctuate.

As long as market-neutral strategies continue to print (+) ROI, MMs will continue to demand leverage to juice up those trades.

However, if a crypto winter strikes & overall trading activities drop, so may demand.

6/ Risk premia

This ☂️ term breaks down into:

- market risk

- counterparty risk

- illiquidity risk

- sovereign risk

- cashflow risk

- volatility risk

(all of which earn premia)

Let's focus on volatility risk & how a new wave of "structured products" is tackling this in crypto.

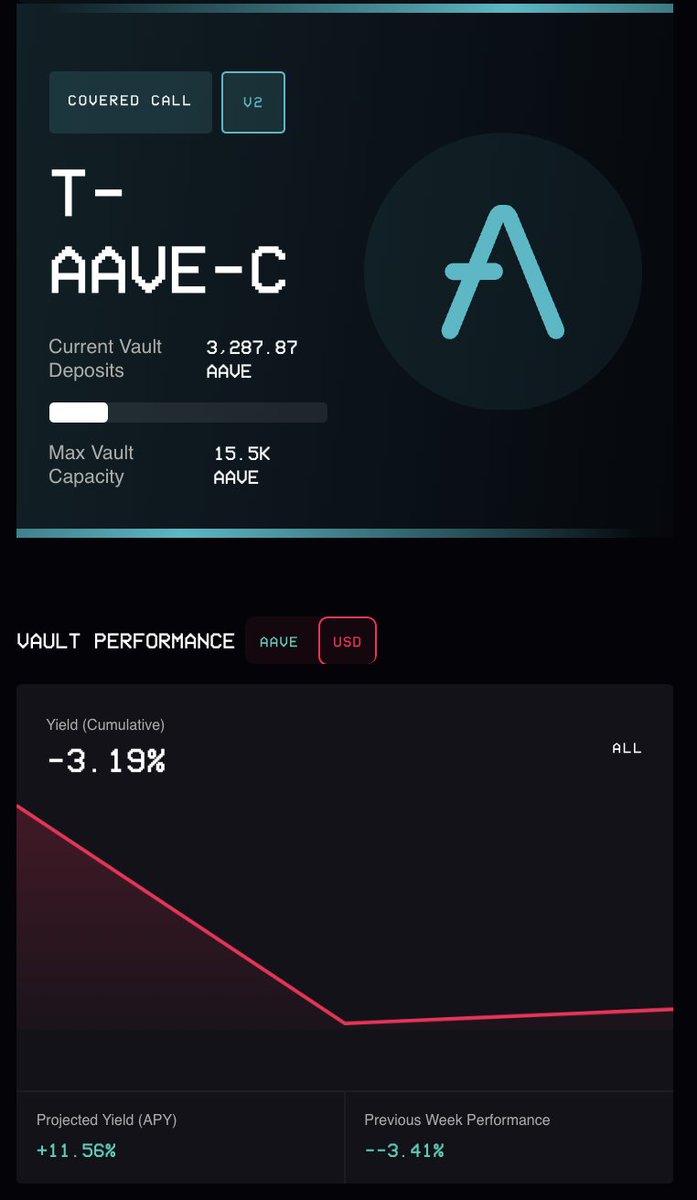

"Structured products" like @ribbonfinance and @Katana_HQ transfer risk premia:

- from traders looking to hedge tail risk (buy options)

- to users looking for yield (sell options)

- by applying users' collateral (ETH, SOL) to write OTM options then passing back theta decay premia

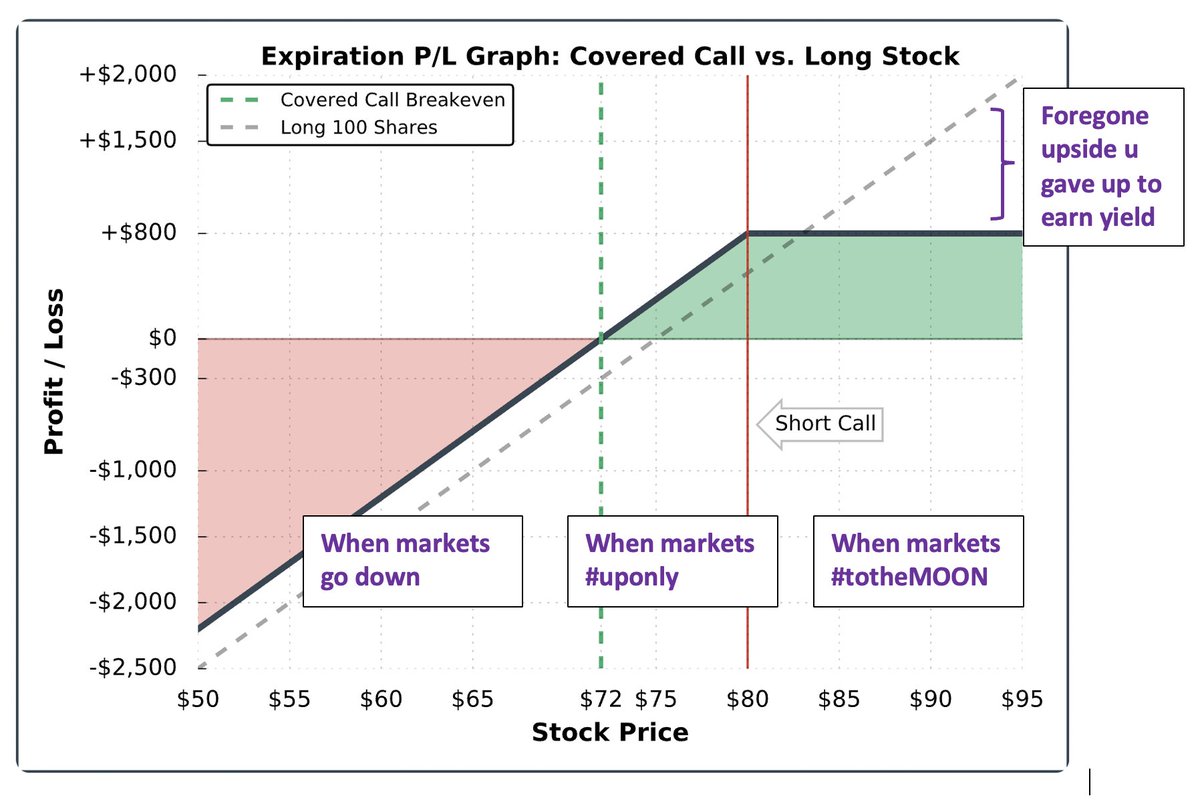

The most common strategy is the covered call.

e.g. buy ETH spot, sell Jan22 ETH $7K calls

Performance depends on market conditions.

- when markets #uponly, CC outperforms (u keep all upside of hodling AND earn theta premium)

- when markets #ToTheMoon, CC underperforms vs hodling

But what about when markets go... down?

Turns out selling vol doesn't *always* return positive yield. Not in crypto; not in tradfi.

Shocker.😲

Is yield from selling options sustainable?

In a smooth steady bull-run, yes.

In a high-vol market reversal, no.

In other words, while on average IV > historical vol, u won't always make money thetaganging. Choose the right portfolio manager who knows how to handle beta risk. 🤔

7/ Protocol Revenue

i.e. when actual cashflows generated from activity on the protocol is used to pay stakeholder yield

This further breaks down into:

- staking profits

- fees collected from liquidity provision

Magnitude of returns for both completely depend on network volumes.

Staking example:

On the Ethereum network, staking means locking up 32 ETH to run validator software.

But say u only have 4 ETH. So you enter into a pool where your contribution & claim to profits is 1/8.

If the validator pool earns 2 ETH, u earn 0.25 ETH or 6.25% personal APY.

LP example:

Say u want to provide liquidity into an ETH-USDC swap pool on Uniswap. Say the total market cap is $295M and you provide another $5M.

The protocol collects 0.3% fee from total trading volumes. Say it earns $12M in a year.

Your profit: 5/300*12M = $200K (4% APY).

Is yield earned from protocol revenue sustainable?

Yes.

But it could fluctuate.

Again, protocol revenue (both staking & LP) is directly proportional to transaction volumes.

So if a crypto winter strikes & overall trading activity drops, so will validator rewards & LP fees.

8/ PIK (payment in kind, i.e. token rewards)

Swap protocols today often issue native governance tokens (on top of protocol fees) to sweeten their deal for LPs.

e.g.

@CurveFinance issues $CRV

@Bancor issues $BNT

When these tokens appreciate, it's like holding venture equity.

Is yield from PIK sustainable?

No.

Sorry.

I mean I get it. In the early days u should reward early users for helping to bootstrap the network.

But in the terminal state most token holders will not be LPs. Continued issuance of LP rewards will just dilute existing stakeholders.

9/ Summary

Crypto yields feel insanely high, propped up by the current bull run. They're sustainable as long as capital inflows & QE continue (because what's the alternative, JPow?)

The 4 sources of yield:

- demand for leverage

- vol premia

- protocol revenue

- token rewards End/

If you found this thread interesting,

@zhusu & @hasufl have a more in-depth talk on where yield comes from. Check it out. ✌️