No More Hustleporn: When No One Pays Their Capital Gains Taxes

Tweet by Jack Raines (✈️,🇦🇷)

https://twitter.com/Jack_Raines

Pronouns: We/Them/Boys • 50% shitposter, 50% thoughtboi • Write for @litcapital • Travel blog: http://backpackin.blog • 6.9/10 newsletter 👇

1) 🚨WHAT'S GOING TO HAPPEN WHEN NO ONE CAN PAY THEIR CAPITAL GAINS TAXES 🚨

As tax season quickly approaches, countless "traders" are going to have their first run in with the tax man.

The problem: many of them reinvested everything and are down bad.

Let's dive in.

2) I, like many of you, saw @darrenrovell's tweet about Odell's Bitcoin salary.

tl;dr: BTC salary = tax event = problem now that $BTC is down 50%.

It got me thinking, what's going to happen to the investors who made bank, but forgot to take out tax $$?

3) There are 2 players who may get hosed here:

Traders who made a killing in '21, didn't set aside tax money, and came into '22 fully invested.

Employees who exercised stock options at high valuations and held all of their shares into steep declines.

I'll break down both.

4) Traders:

You started 2021 with $50k. Thanks to GME, Doge, crypto, growth stocks, etc. you made $1M. You flex on Linkedin and quit your job (like the guy pictured).

Congrats 🤝

You are about to owe a ton of taxes. Web3 hasn't beat the tax code yet.

How much is the bill?

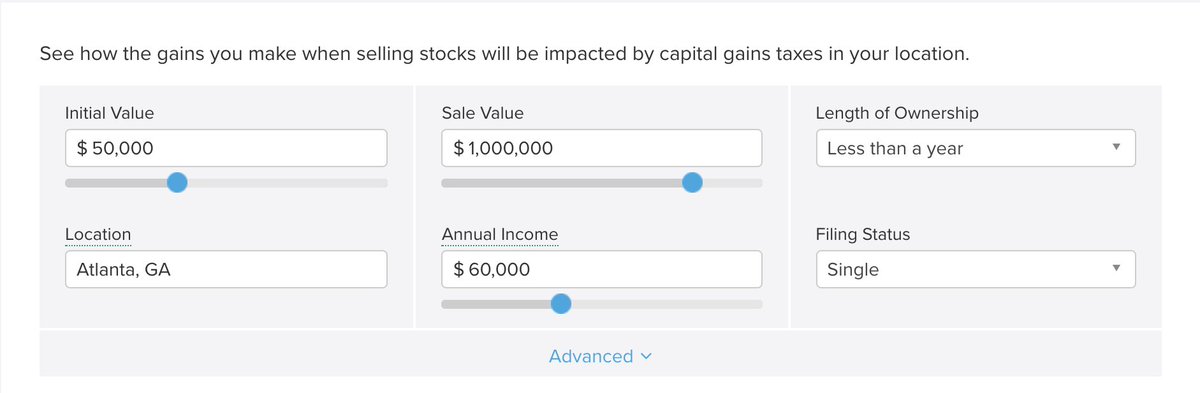

5) Because you traded within a year, your profits are taxed as short-term capital gains. These use normal income tax rates.

Say you have a $60k salary and made $1M trading. In Atlanta (my home), you would owe $411,675 in capital gains taxes 🚩🚩🚩

6) Your employer already accounted for work income taxes. Your broker didn't account for cap gains taxes.

But you didn't pull out $400k. You continually redeployed your capital after each trade. There are a ton of assets that are down badly from 2021 peaks.

7) $BTC is down 50% from its peak.

$ETH -55%

$Z -75%

$NET -63%

$UPST -81%

$NFLX -48%

$PTON -100% (jk, only -83%).

Don't get me started on $GME or $AMC. Let's say after hitting $1M last year, you reinvested in growth/crypto.

Now you're down 60% from peak. $400k portfolio.

8) But you held those growth/crypto positions THROUGH the end of 2021.

Assuming your last trades of 2021 were near your peak account value of $1M, your tax bill is based on that $950k capital gain.

Tax bill: $411k.

Current portfolio: $400k.

You owe your whole portfolio.

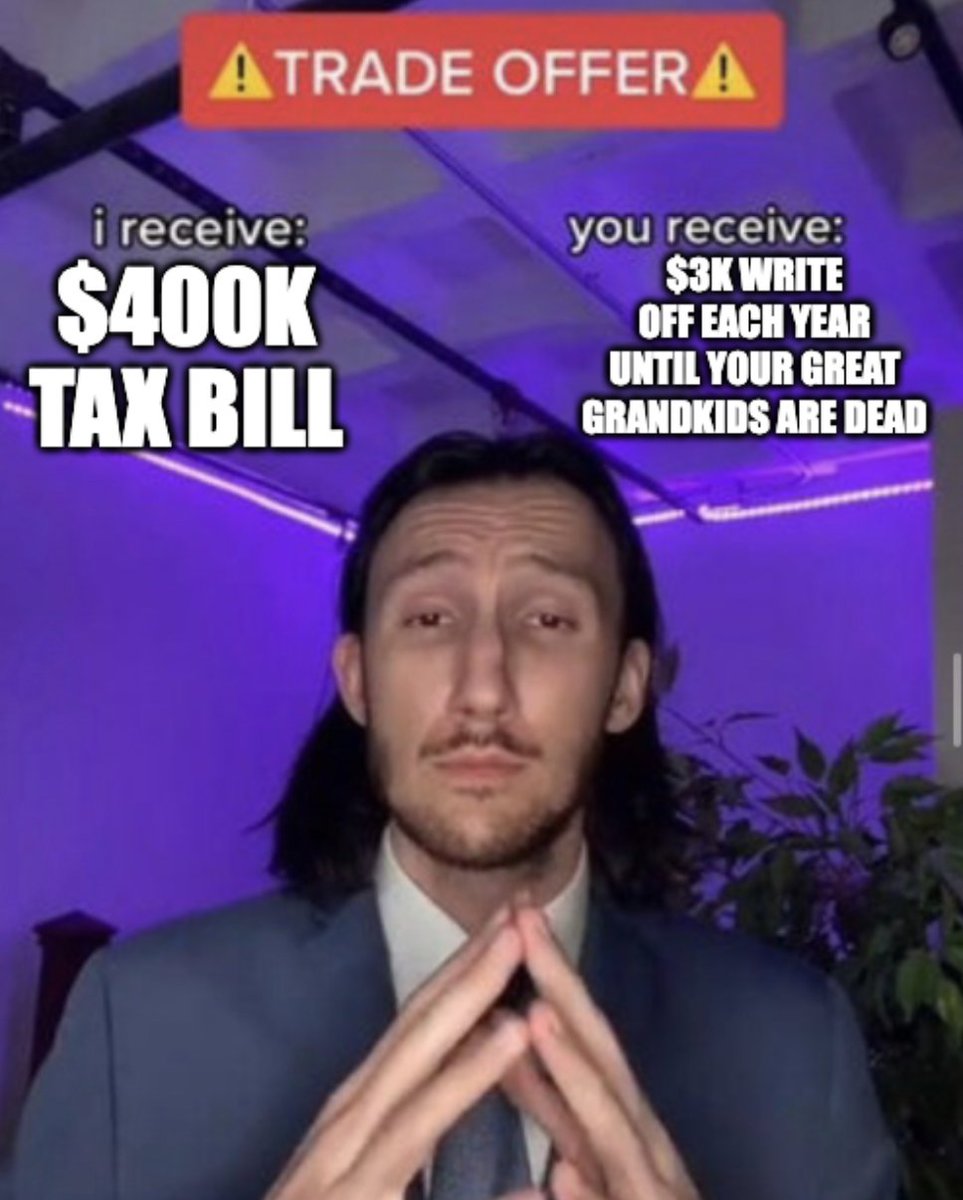

9) Taxes on gains for any year have no limit, but loss write offs cap at $3k a year (though further losses carry forward).

You owe $400k in 2021 taxes. You sell your whole portfolio to pay the bill.

You record a $600k loss for 2022. You get a $3k write off for 200 years.

10) You just round-tripped $1M. Thanks for playing, enjoy the write off.

You used margin? You can add debt on top of that. Bigger losses? You can't afford the bill.

The timing of sales and holding through EOY can have huge implications with Q1 bear markets.

Now RSUs (options).

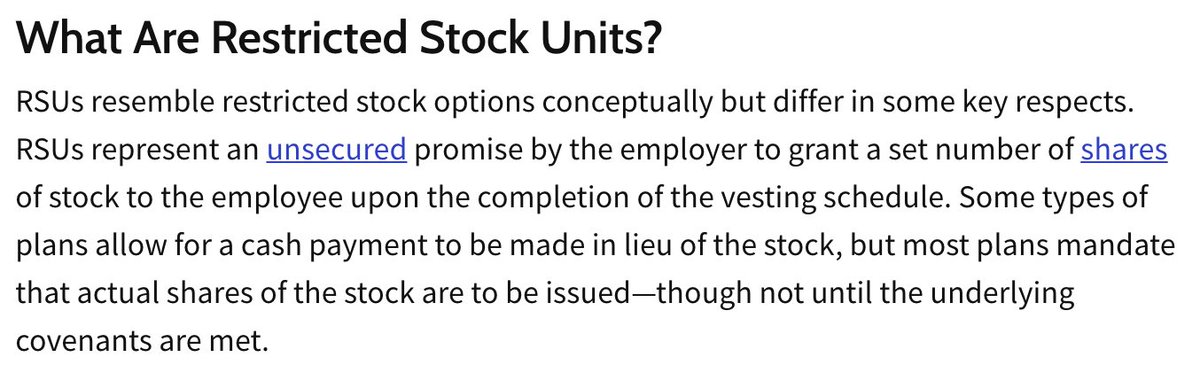

11) RSUs are a form of stock options. See Investopedia's definition below.

Some companies offer stock plans allowing employees to purchase below market price. In these cases, taxable events occur at time of sale.

RSUs differ in that they become taxable at the date of vesting ‼️

12) Why does this matter?

Let's use fallen angel $PTON.

Say you've worked there for several years, and you had 1k RSU shares that vested Q1 2021. Peloton was trading at ~$150 a share at that point. Taxable event: $150k in additional income in 2021.

13) But you didn't sell, because you believed in the company. Now we're in 2022, and tax season is coming up.

With a $150k salary + $150k RSU, your RSU bill is ~$60k.

But you never sold your 1k shares.

They are now worth $27k.

You are $33k short thanks to the price dropping.

14) This actually happened a lot when the dotcom bubble crashed. Check out this piece from 2001:

Taxes are a criminally under-discussed aspect of finance, especially when we're dealing with stocks.

chicagotribune.com/sns-tech-taxes…

https://www.chicagotribune.com/sns-tech-taxes-story.html

15) I believe this will be an important theme in coming months.

Moral of the story: always account for the tax man. Your positions can and will decline at some point, and poor timing can kill you.

Or just day trade a Roth IRA like I did in 2020. No taxes, no problems.