BNPL (Buy Now Pay Later)

Tweet by Alex Rampell

https://twitter.com/arampell?s=20

Silicon Valley entrepreneur (cofounder@ TrialPay, Yub, Affirm, Point, TXN), investor (General Partner @a16z), husband, father and sarcast (one who is sarcastic)

1/ Why is “Buy Now, Pay Later” (BNPL) an early threat to trillions of dollars of market cap - Visa (almost $500B), MasterCard ($350B), card issuing banks, acquiring banks/services (Fiserv, FIS, Global Payments, etc)?

2/ Behind every card transaction there are FIVE parties: consumer -> issuing bank -> network (V/MA) -> acquiring bank -> merchant. The middle three get zero data on what items (“SKUs”) are being bought. Short video I made here:

3/ BNPL makes no sense for, say, a $5 transaction at Walgreens. But do you want to get a 2 meter long paper receipt which you need to return that $5 item? Because of the architecture, there’s no way for the issuer to receive that AND the merchant doesn’t want to give it to them

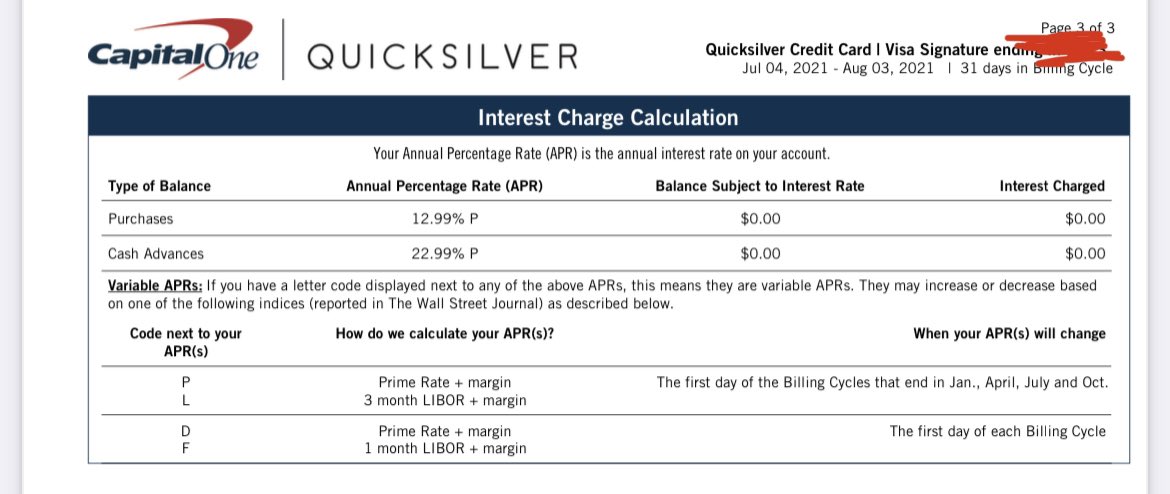

4/ Because the issuer, network, and merchant acquirer do not see SKU-level detail, financing is just “cash advance” and “everything else”

What if a merchant wants to lower the rate for SOME items? (Sell more!) What if a *manufacturer* wants to lower it across merchants? No can do

5/ This what makes BNPL so interesting. It’s a **parallel** network, with SKU level information, that bypasses the issuing bank, card network, and merchant acquirer. It’s just the consumer, the merchant, AND (this is exciting!) a new participant: the product manufacturer!

6/ Let’s say Samsung wants to create an installment payment plan for their new $1000 phone (b/c lower pricing sells more stuff!). How do they do this at, say, Walmart and Target and Amazon? When everyone has a different kind of credit card and those issuers don’t see SKUs? BNPL!

7/ Right now this parallel network is being used for installments / customized financing - the clear product-market need and the hole the “one size fits all because of no SKU-data and five parties” created. But adding SKU-level info and manufacturers is a HUGE unlock for more

8/ There have been many attempts to build a competing payment network (eg MCX: en.wikipedia.org/wiki/Merchant_…) but they failed to address a consumer need. BNPL has both consumer demand and merchant demand, albeit for a subset of transactions

Merchant Customer Exchange - Wikipediahttps://en.wikipedia.org/wiki/Merchant_Customer_Exchange

9/ Over time, there’s no reason why any transaction - even the $5 Walgreens one - cannot be run over the BNPL rails, which are signing up merchants and consumers at an aggressive clip. Rather than a financing carrot, it might be a discount carrot, a warranty carrot, etc 10/ Walmart et al created MCX because they hate (understandably so!) paying ~2% interchange fees. But those fees are protected by a very very powerful network effect. Walmart tried playing chicken in Canada — cutting off Visa cards in 2016 — and lost:

11/ So you really need a *ubiquitous parallel network* with *consumer benefit* in order to go cold turkey against the current oligopoly and not lose sales. BNPL is just that. Merchants already use it, consumers already use it, and SKU data passes freely.

12/ As the mobile phone increasingly becomes the consumer wallet, and as merchant payment terminals become smarter, you can also imagine a world where payments (and loans) automatically shift to the lowest cost/highest benefit provider…more here:

13/ Open-loop payments (the V/MA system) are one of the greatest network effects of all time, and have created and *captured* tons of value. The moat is immense. But BNPL and mobile wallets are creating the first market-based (not regulation-based) cracks in the fortress.